In a trusting society where we accept that the orders we place will arrive as intended, errors do happen sometimes. In the context of business, 3-way matching is the easiest method to keep a check on delivery errors or fraud.

The most satisfying part of starting a business is creating a trustworthy relationship with the suppliers. But it can be difficult during the initial days and contacts.

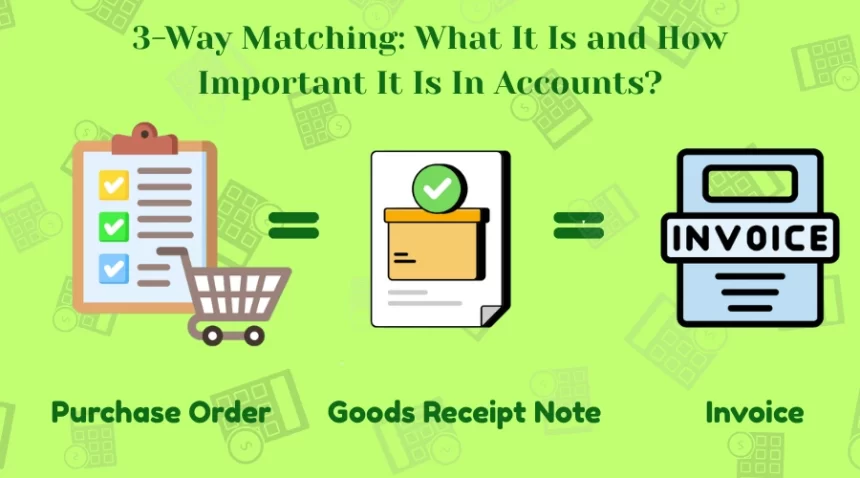

The most important step between delivery and payment is systematically comparing the key document details that are generated during every transaction. The documents can be a purchase order, vendor’s invoice, and delivery receipt. This comparison is particularly known as 3-way matching.

Today, we will learn why these documents form the basis of accuracy in the accounts payable ledger and how the matching works.

What does 3-way matching mean in accounts payable?

The 3-way matching is a controlled measure that should be taken while ordering goods and services. It will guard you from receiving the wrong orders or any fraud.

The key documents required for the guardrail are

- Purchase Order (PO)

- Vendor Invoice

- Receiving Report

Ahead of any payments, make sure these documents agree with each other.

It is important to make sure that the documents are checked at all stages, as they can have potential errors. The worst-case scenario can be slipping a fake version by fraudsters into the system so that the payments are made incorrectly.

The verification of all three documents will minimize the risk potential.

Components Required in 3-Way Matching:

You might have a question: Why only these three?. The answer lies in what each document does if and when required:

- Purchase Order (PO)

When ordering goods or services, the purchase order slip mentions the item details, quantity, and expected price. It is the initial document that sets the entire transaction.

- Receiving Report

Also known as a delivery receipt, this document verifies and cross-checks with the PO about the goods and services conditions and quantity and validates that the physically received items match the previously initiated document.

- Vendor Invoice

The final document of the transaction. This supplier’s bill has the amount owed for the goods and services provided. The invoice should have prices that were initially agreed on, quantity, and the total matching the purchase order.

It’s important to note that if you are ordering physical goods, the invoice will either be with the goods or will arrive shortly after. In case you are rendering services, the invoices are sent every month, at the end of the month, or on the agreed schedule.

If the three documents match, it proves that:

- The genuineness of the ordered goods.

- The validation of the received items

- The correct bill completes the audit trail

Primacy of 3-Way Matching

Here’s how 3-way matching strengthens the financial process:

- Accuracy Enhanced

The process of 3-way matching reduces the risk of incorrect payments or goods not received as ordered.

- Prevention of Fraud

With the creation of strong internal controls, fraudulent activities are minimized.

- Improvement in the vendor’s relationship

The 3-way matching helps to create a strong and confident partnership, demonstrating trustworthy financial administration.

- Audit Trails and compliance

3-way matching leads to verifying the audit trail and facilitates compliance with internal and external finance regulations.

Drawbacks of 3-Way Matching

Just as every coin has two sides, 3-way matching also has some challenges, no matter how much value it adds to the financial process:

- Complex

The inconsistent data formats, units of measurement, and descriptions in all three documents can be a bit complex if you are managing large orders without an automated system.

- Intensive Resources

The comparison of the documents requires staff that are dedicated and give attention to details. This can strain the resources, especially if it’s a high transaction.

- Delay In Payments

It’s important to catch the discrepancies, but it should also be noted that if any issue occurs, the payments get delayed.

Make 3-Way Match More Effective With Automation

Because automated 3-way matching is rule-based, it improves credibility and is a standard component of accounts payable software. You can configure your system to do checks according to predefined criteria, guaranteeing consistent matching each and every time.

By extracting data from paper or emailed bills, Optical Character Recognition (OCR) technology expedites invoice processing and does away with the need for manual data entry, which is prone to errors.

You may optimize your overall financial workflow by using automated tools to compare papers, spot inconsistencies, and flag them for review.

Additionally, better accuracy and smooth data flow are made possible by connectivity with your current enterprise resource planning (ERP) system. Every matching document is stored in the cloud, where it is readily available for audits and future reference.

For more finance-related queries, visit www.megafeedz.com.

FAQs

Q1. What makes three-way matching crucial?

Ans: By guaranteeing that businesses only pay for the precise amount of goods and services they agreed upon and received, three-way matching contributes to cost savings and budget efficiency. Because AP teams can process invoices more quickly and with fewer time-consuming problems to rectify, the increased accuracy also saves time.

Q2. In accounts payable, what are two-way and three-way matching?

Ans: In accounts payable checks, two-way matching guarantees that the information on the invoice and purchase order match. In accounts payable, 3-way matching goes one step further and verifies that the information on the sales receipt, invoice, and purchase order matches.

Q3. Which division conducts the three-way match?

Ans: The accounts payable department is in charge of managing the three-way match procedure as a best practice. Some companies combine accounts payable and buying under one roof.

Q4. What are service received notes (SRNs) and goods received notes (GRNs)?

Ans: When goods or services are delivered, the buyer issues a document known as a Goods Received Note (GRN) or Service Received Note (SRN). Its objective is to verify and document the seller’s delivered items by checking or validating them.

Q5. What is a net seven invoice?

Ans: The accounting term “Net 7” refers to the day on which your invoice will be paid. Seven days following the invoice’s latest earnings date, your invoice will be paid. The date range for your earnings can be found in the ‘Payments’ module under the ‘Date’ column.